Table of Content

The length of time you take to pay back the loan also affects your monthly payment amount. You can lower your payments if you make the full interest-free period and pay off the loan as quickly as possible. Use the calculator below to calculate your monthly home equity payment for the loan from DCU.

There are many factors you should consider when refinancing a mortgage. Use our mortgage refinance calculators to estimate the cost and potential savings. Stop Payment - Request a stop payment order if the transaction has not yet cleared your account. Also use as an affidavit of an unauthorized or improper ACH debit. Give ideas and general feedback about what we're doing right, what we could do better, or what new products and/or services you would like us to provide. Please be aware that using this form is not a secure way to send sensitive personal and/or financial information.

Apply for a Loan Through Online Applications

Have you been putting off home improvement projects or other large purchases? If you’re waiting for the right circumstances to use your home equity loan or line of credit, now is a great time to move forward. Home Buying Guide Save money on buying a new home and get the best rates for refinancing or improving your home. Pay off credit cards or invest in home improvements with our traditional personal loan. A DCU Fixed-Rate Equity Loan or Home Equity Line of Credit gives you the ability to borrow against your home’s equity to pay for major purchases, home improvements, and more. Local time on Saturday, December 24, and remain closed through Monday, December 26, in observance of Christmas.

As the name suggests, a fixed rate stays the same for the life of the loan. That also means the monthly payments are the same for the entire loan. A fixed-rate loan product that uses the equity in your home to provide a "lump sum" loan amount you pay down with fixed monthly payments over a set period of time. It's ideal for a one-time home improvement project, large expenses or purchases.

A Home Equity Line Of Credit, Aka Heloc, Is Based On A Variable Rate.

May be used for Traditional, Roth, SEP, and SIMPLE accounts. Build or rebuild your credit rating as you build savings. ²The "Index" for the quarter beginning October 1, 2022 is 5.50%, which was the Prime index published in the Wall Street Journal on the first business day of September 2022. The interest rate will not exceed 18.00% regardless of the Index.

For Visa, Home Equity, and Consumer Loan Applications, most members can expect an answer while still online. Apply for Loans by Phone – Apply for Consumer, Visa, Home Equity or Mortgage loans with a representative or by touch-tone phone. Our 24-hour Consumer Loan Call Center can usually give you an answer on your request while you're still on the line. Easy Touch Telephone Teller – Provides 24-hour access to your accounts by touch-tone phone. All you need is your Member Number and PIN to login and use it.

Joint owner apply for home equity loan

Consult a financial professional prior to relying on the results presented. Calculation results does not indicate whether you qualify for a loan or assumes you could qualify for the loan, product or service. Find out how to keep your money safe, what type of accounts may be right for you and what basic banking lingo you need to know. Your savings federally insured to at least $250,000 and backed by the full faith and credit of the United States Government. Delta Community's Home Equity Loan is considered a traditional second mortgage and is desirable if you need a one-time specific amount of money. Shopping around for the lowest APR is integral to getting the most out of your loan.

The first step to take when you want to obtain a home equity loan is to gather information on the equity that you have in your home. This information can be found on your most recent property tax statement or statements. This way, you do not forget important information and you do not leave any gaps in your loan. You can borrow up to 100% of the value of your property as your second mortgage. This means that you can borrow as much money as you want up to a maximum of the total value of your property.

The Annual Percentage Rate for our undergraduate and graduate private education line of credit will be fixed for the life of the loan. A rate lock is a process in which we “lock in” your interest rate, ensuring that it will not change through the closing of your loan. Rates may not be locked for prequalification/preapprovals. For Purchases, you may lock your interest rate within 60 days of your closing date.

Initial rate is usually lower than that of a fixed-rate mortgage. You are about to enter a website hosted by an organization separate from DCU. Privacy and security policies of DCU will not apply once you leave our site. We encourage you to read and evaluate the privacy policy and level of security of any site you visit when you enter the site. While we strive to only link you to companies and organizations that we feel offer useful information, DCU does not directly support nor guarantee claims made by these sites. The loan process was easy and fast, and they had the best rate by far.

DCU service for the life of the loan– We’ll service your loan as long as you have it. No need to worry about making payments to a different lender. Consistent payments– You’ll have the same principal and interest payment for the life of the loan. Fixed-Rate Home Equity loans are available in all 50 states. Personal loans can be a great way to maintain or build one’s credit history while covering the cost of an unexpected expense.

If you already have a house or land with equity built in it, you can combine your debts into one loan. This allows you to get lower interest rates, stretch your monthly payments over a longer period, and pay off multiple debts at once. You can do this regardless of how much equity you have in your home. A dcu home equity loan is an equity loan which enables you to utilize the equity within your property to borrow funds.

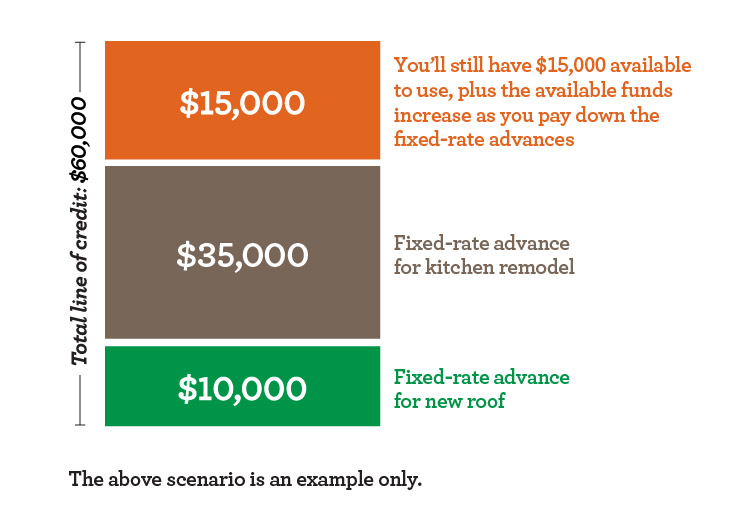

Your home equity provides a low-cost option for borrowing money at interest rates that are tough to beat. Great rates with no annual fees, cash advance fees, or balance transfer fees. Fixed-rate option available– Offering the option to lock in at a fixed rate on up to two advanced portions of your loan at a time, minimum advance to lock is $5,000.00. Borrowers who already own their homes but need a little extra cash can apply for one of these home equity loans. In general, you can apply for a loan using the equity you already have on your home.

They also provided great support and were responsive throughout the process. Receive the best home equity and mortgage rates every month right to your inbox. Home equity loans are great if you know exactly how much cash you need. You can use the loan for anything—but if you use it for home improvement, you can deduct the interest from your income tax .

Plan for Your Mortgage Loan

³Current offered rate are calculated by using the Index, Margin and Floor value in effect. Your specific Interest Rate, Margin, Floor, and/or credit approval depends upon the credit qualifications of the student borrower and co-borrower . Student borrowers may apply with a creditworthy co-borrower which may result in a better chance of approval and/or lower interest rate. One of the benefits of financing with DCU is that we will service your loan as long as you have it. The term D cu means the difference between the market value of a person’s house and their loan balance. This loan is a type of second mortgage, meaning that it is secured by your home and the lender can take possession of your property should you default on the loan.

No comments:

Post a Comment