Table of Content

DCU wants to ensure that you can leverage one of your most powerful assets—the equity in your home. Use it as a resource to pay for remodeling, major expenses, debt consolidation and more. Now I would like to see if I can get my mother to join and possibly obtain a loan or HELOC. I doubt you're the first person looking to get a second HELOC, but I'd be interested ot hear how it all plays out. Looking to take advantage of the equity you’ve built in your home?

You borrow a lump sum all at once, and your monthly payment never changes for the life of the loan. Along with LTV ratios and credit scores, home equity loan rates are also based on the length of the loan. DCU offers home equity loans for a variety of time periods, ranging from five to twenty years. DCU has a maximum LTV ratio of 90% for its home equity loans.

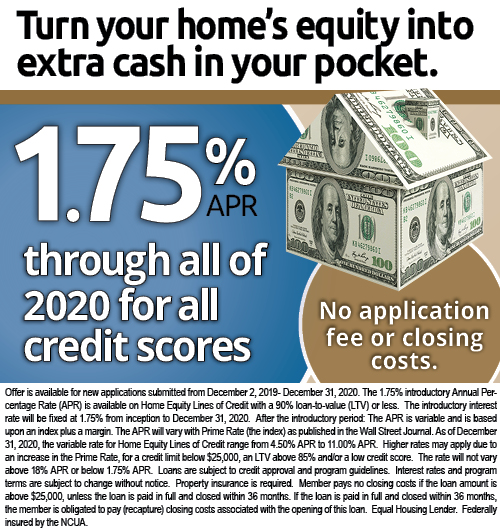

Home Equity Line of Credit

DCU was chartered in 1979 and is now one of the nation’s 20 largest credit unions. A key to its growth is serving as the credit union to over 700 companies and organizations. By extending membership eligibility to employees of those companies and organizations plus their family members, DCU has served a larger number of consumers across the country. For a complete listing of all of DCU’s fees and service charges, please see the Schedule of Fees and Service Charges. New or used vehicles and vehicle modifications to aid people with disabilities.

The length of time you take to pay back the loan also affects your monthly payment amount. You can lower your payments if you make the full interest-free period and pay off the loan as quickly as possible. Use the calculator below to calculate your monthly home equity payment for the loan from DCU.

What is the difference between a Fixed-Rate vs. Adjustable-Rate Mortgage?

A cash out refinance allows you to tap into the equity in your home. After you close, you’ll receive a check for the difference between your current mortgage payoff + closing costs and your loan amount. A rate and term refinance changes your interest rate and/or the term of your mortgage, typically loan amount remains the same unless you wish to roll closing costs in. There are several reasons you may consider refinancing your home. You may be able to lower your interest rate, reduce your payments, change the term of your loan term, or even tap into the equity of your home.

You can adjust loan amount, interest rate, and the home equity term to view the impact on the monthly payment amount. The calculator also provides an amortization table to show the amount of principal and interest payments a borrower will make over the life of the loan. Low competitive fixed rates your rate is determined by your personal credit history. Homeowners often choose a home equity loan when they need a lower dollar amount than with a conventional first mortgage.

Home Equity Loan product from DCU - Amortization Schedule Calculator

The APR for home equity loans and home equity lines are calculated differently, and side be side comparisons can be complicated. For traditional home equity loans, the APR includes points and other finance charges, while the APR for a home equity line is based solely on the periodic interest rate. A home equity loan is a good option if you have a large expense and know exactly how much money you’ll need. Your payment will stay the same every month and you’ll know exactly when it will be paid off. Enjoy 100% financing and no private mortgage insurance.

Let’s look at some common examples of when not to use a HELOC. A home equity line of credit can be a great way to fund a number of life events and financial situations. Please refer to DCU's Early Federal Disclosure for more information on Home Equity rates, including historical rate examples.

Apply for a Loan Through Online Applications

DCU explains how cash-out refinancing works and when it makes financial sense. Keep in mind that things like your appraisal or a delay in providing necessary documentation may slow down the process. Choose from our easy to use calculators to plan for your mortgage refinance. Verification of Deposit Letter - Request a Verification of Deposit letter verifying your account balance and history. Account Activity Letter - Generate a printable letter with details of account activity. Just click on the application and follow the instructions.

Please do not include any confidential information when using this form such as your Social Security number, account number, your PIN, date of birth, etc. For secure email, log into Online Banking and choose Contact Us. At Bills.com, we strive to help you make financial decisions with confidence. For more information regarding Bills.com’s relationship with advertised service providers see our Advertiser Disclosures.

HELOC Fixed Rate Advance - Request a fixed rate advance from your Equity LinePLUS. Financial Relief Form - Apply to receive financial assistance with your payments. At a time when many lenders have discontinued or at least limited their home equity lending, DCU still provides a range of home equity loans and HELOCs. Unless a person is already a member of DCU, applying for a home equity loan from them would be a two-step process. Assuming that the application is accepted, the second step would be applying for a loan or HELOC. HELOCs are divided into a draw phase and a repayment phase.

You may be tempted by offers that allow you to borrow up to 120% of your home’s equity. Be aware that any interest above the home’s equity limit is not tax deductible. Additionally, you won’t be able to sell your home until the lien is satisfied, which can negatively impact the marketability of your home.

No comments:

Post a Comment